Missing millions

“What gets lost in that chain of logic, of course, is the greater public good. As corporations work all the tax angles, ordinary taxpayers in both rich and less-rich countries get stuck with a bigger bill from their governments, while the governments themselves scramble to find the revenue they need to pay for all kinds of services.”

“It contributes mightily to the growing gulf between the wealthy few and the struggling many. And it feeds the paradox of private wealth amid public squalor.” – Editorial, The Star, Toronto – [expand title=”source”] Source: https://somo.nu/2Hb1aVq[/expand]

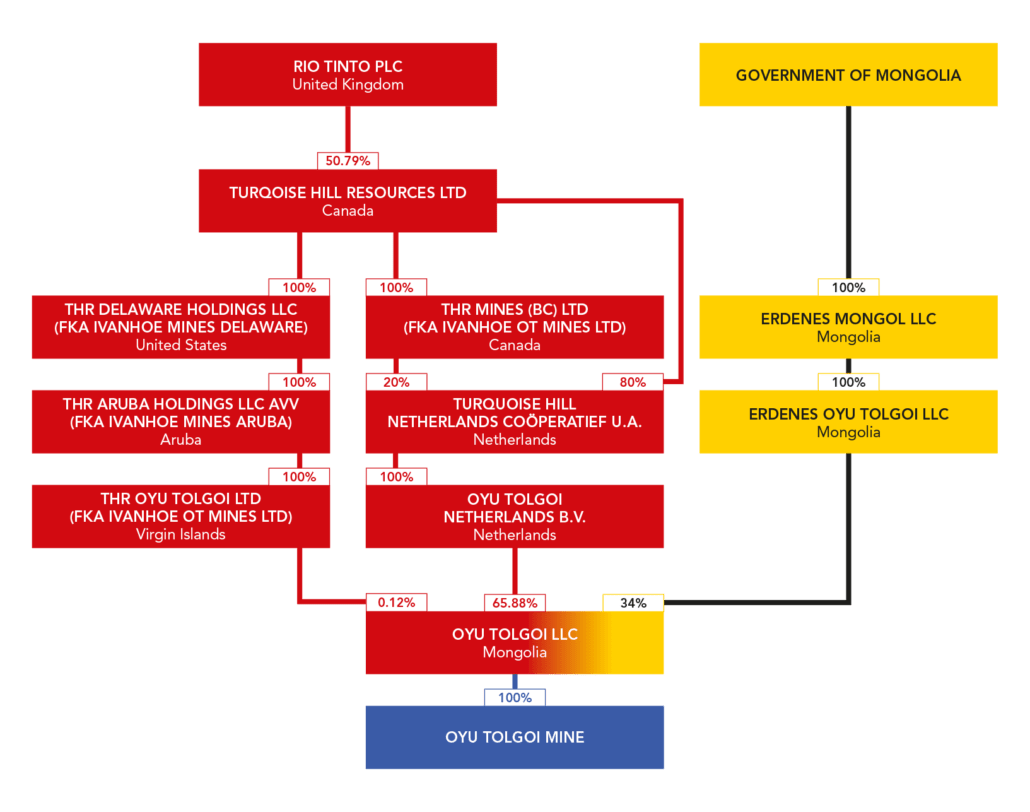

Ownership of the mine

The Oyu Tolgoi mineral deposit was originally owned by the Canadian mining company Ivanhoe Mines, until Anglo-Australian mining giant Rio Tinto attained a majority stake in Ivanhoe in 2012. Subsequently, Ivanhoe Mines changed its name to Turquoise Hill Resources – in which Rio Tinto now has a 51% stake. Turquoise Hill Resources is registered in Canada, while the remaining 49% of its shares are listed on the New York Stock Exchange.

Both the Oyu Tolgoi open pit mine (phase 1) and the underground mine (phase 2), which is currently under development, are directly owned by a Mongolian company called Oyu Tolgoi LLC. But the actual operator of the Oyu Tolgoi mine is Rio Tinto. In this way, Rio Tinto is both majority owner and direct controller of the mine.

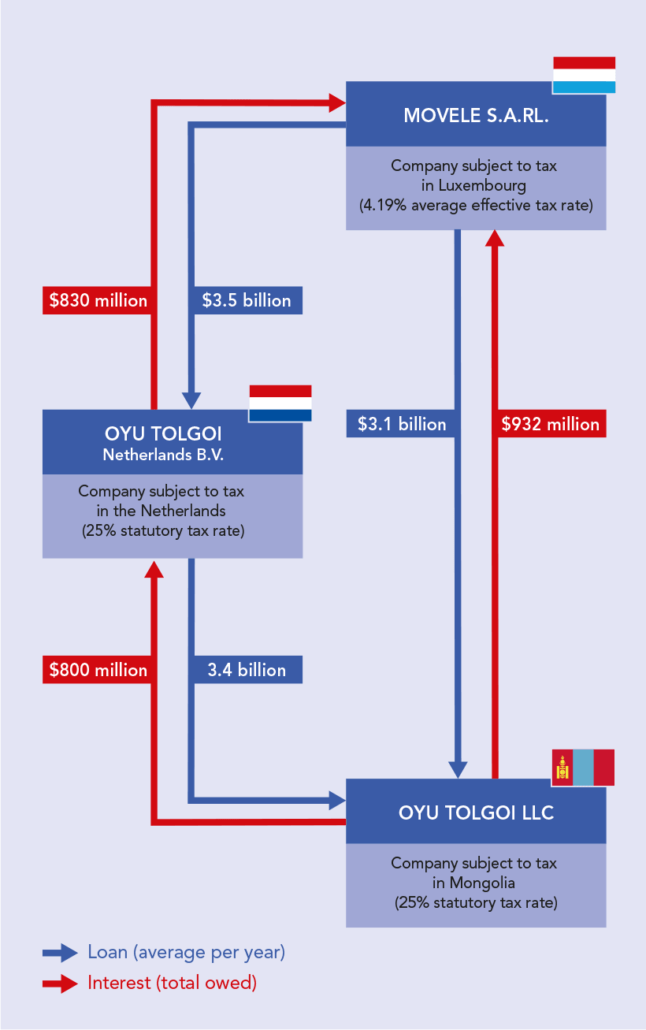

The ownership structure shows multiple subsidiaries in tax havens: the Netherlands, the British Virgin Islands, Aruba and Delaware. The fiscal details behind having these is explained in ‘Mining Taxes‘.

Apart from the Oyu Tolgoi mine itself, Oyu Tolgoi LLC – and thus ultimately Rio Tinto as its majority shareholder – also has a stake in mining licences for several other nearby mineral deposits too.

Along with Rio Tinto, the other major corporate shareholders of Turquoise Hill Resources – thus also beneficial owners of the Oyu Tolgoi mine – include (as of 24 January 2020):

Most of these companies are investment managers, with the exception of Credit Suisse and Nomura, which are brokerage firms. Temasek Holdings is the Singaporean state-owned company that manages the country’s sovereign wealth fund, and is along with Rio Tinto a strategic entity.

Ten pension funds also hold stakes in Oyu Tolgoi, the most notable ones being:

The Netherlands has a strong interest in the mine. Three of the subsidiaries are Dutch and the Dutch development Bank finances the mine. Furthermore, two of the Netherlands’ largest pension funds – ABP and PGGM – also own Turquoise Hill Resources shares, valued respectively at US$ 2.24 million and US$ 0.92. There are also sovereign wealth funds from Norway (US$ 12.8 million) and Alberta (US $ 0.5 million).

Dubai Agreement

Rio Tinto managed to attract US$ 4.4 billion in finance from banks, export-credit insurance agencies, and national and supranational financial institutions, to finance the underground development of Oyu Tolgoi. This deal was signed in 2015 and is known as the Dubai Agreement.

Notable financial institutions involved in this financing arrangement are the European Bank for Reconstruction and Development (EBRD), the World Bank Group’s International Finance Corporation (IFC) and Multilateral Investment Guarantee Agency (MIGA), the Dutch Financierings-Maatschappij voor Ontwikkelingslanden (FMO), Export Development Canada, the Australian Export Finance and Insurance Corporation, and the US Export-Import Bank.

Oyu Tolgoi’s finance structure geared towards tax avoidance raises concerns over whether the huge amount of finance coming from these public and semi-public financial institutions – provided by taxpayers in these institutions’ respective countries or regions – will feed into the same financial construction and thereby lead to further tax avoidance.